2022 was a challenging year for the global economy, marked by the conflict in Ukraine, heightened geopolitical tensions, slowing global growth, soaring inflation, rising interest rates, and extreme weather events.

However, amidst a tough environment, Keppel continued to push ahead with our Vision 2030 strategy to be one integrated business, providing solutions for a sustainable world.

We have made significant progress in simplifying and focusing our business, with the divestment of our logistics business, and the proposed combination of Keppel Offshore & Marine (Keppel O&M) and Sembcorp Marine. We are grateful to Keppel’s shareholders who have voted overwhelming in support of the proposed offshore and marine (O&M) transactions at Keppel’s Extraordinary General Meeting last month.

When the transactions are completed, it would fast-track Keppel’s transformation from a conglomerate of diverse parts into one integrated business - a global asset manager and operator, with strong capabilities in energy and environment, urban development and connectivity, all part of a continuous value chain.

We have made good progress in asset monetisation, with about $4.6 billion announced as at end December 2022 since the start of the programme, well on track to exceed our target of $3-5 billion by the end of 2023. We will not stop at $5 billion but will continue to unlock capital which can be used to invest in our growth engines alongside co-investors and also reward our shareholders.

Harnessing our asset-light model, we announced about $2.8 billion worth of energy & environment and sustainable urban renewal-related investments in 2022, jointly undertaken by Keppel together with the private funds and/or business trust managed by Keppel Capital. We see Asset Management not just as a vertical within the Group, but a key business and a horizontal that pulls the Group together, allowing us to leverage our capabilities to tap third party funds for growth.

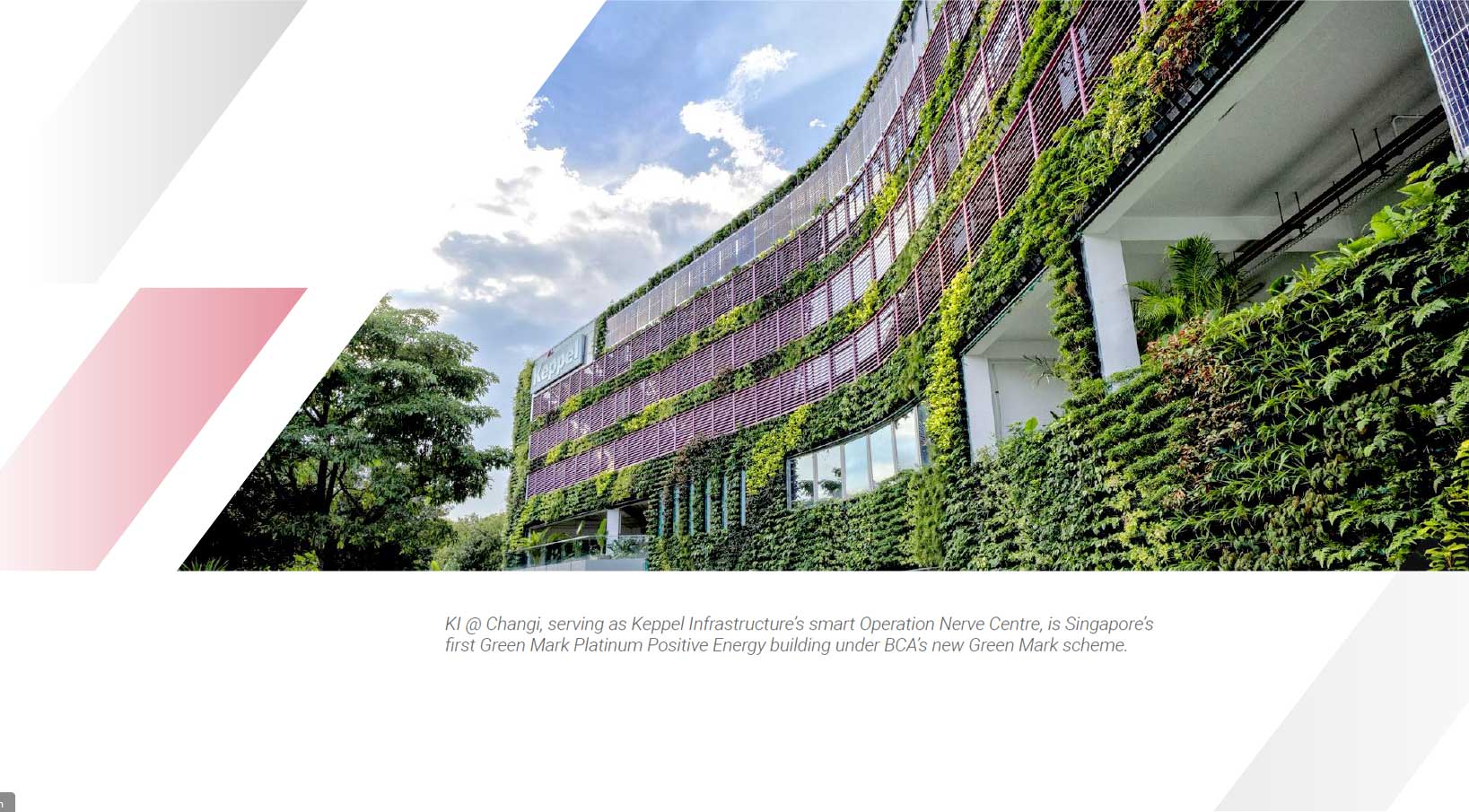

During the year, we actively expanded our business in Vision 2030 growth areas, such as renewables, clean energy and environmental solutions. We achieved many “firsts”, including commencing Singapore’s first renewable energy import, the development of Singapore’s first hydrogen-ready power plant, and the opening of Keppel Infrastructure @ Changi, Singapore’s first Green Mark Platinum Positive Energy building under the new and more stringent Green Mark scheme, as a step towards bolstering our sustainable Energy-as-a-Service business.

Our announced portfolio of renewable energy assets has more than doubled to 2.6 GW, including projects under development, compared to 1.1 GW at the start of 2022, on track towards our target of 7 GW by 2030.

The China real estate market faced considerable headwinds in 2022, exacerbated by strict COVID-19 restrictions, which the authorities have started relaxing. While challenges remain, all pandemics will end eventually, and we remain confident about China’s long-term potential. In the meantime, Keppel Land continues to focus on growing its recurring income. It is expanding its presence in India, and seizing opportunities in sustainable urban renewal and senior living.

In our Connectivity segment, we scaled up our data centre business with the acquisition of data centres in China and the UK, while pushing ahead to lower the carbon footprint of data centres. Design and development of the Bifrost subsea cable system is progressing well. M1 continued its digital transformation and made good progress in growing its enterprise business and rolling out its 5G standalone network. We see the trend of increasing digitalisation, including cloud computing, artificial intelligence and the metaverse, generating further demand for the Group’s digital connectivity solutions.

Amidst a volatile environment with inflation and rising interest rates, we continued to strengthen our business resilience. As at end-September 2022, about 70% of the Group’s borrowings were on fixed rates, with an average interest cost of 2.88% and weighted tenor of about 3 years.

Keppel’s business has also been pivoting away from the Engineering Procurement and Construction (EPC) and development for sale models, which have lumpier earnings, towards providing essential and value-adding services, with a focus on recurring income. This should improve the Group’s resilience in the period ahead, when the external environment is more uncertain.

To prepare for the fast-changing environment as well as the next phase of Keppel’s transformation to be a global asset manager and operator, we have been identifying the skillsets that we need, building up our bench strength and investing in training and development.

We also continued the Group’s digitalisation efforts, with the setting up of a data lake and a single source of truth. With the data in a form that facilitates analytics as well as automation, we can improve productivity and customer experience, perform continuous assurance and audits, and seize new opportunities through changing how we serve our customers, such as through Real Estate-as-a-Service, or Keppel Infrastructure’s smart Operation Nerve Centre.

To test and further enhance the resilience of Keppel’s Vision 2030 strategy, we conducted a Group-wide scenario planning exercise in 3Q 2022. Three scenarios were developed exploring a range of outcomes in the 2030 timeframe related to (i) the geopolitical and economic order, (ii) the climate change response and energy transition landscape, and (iii) the global financial environment. The intention was not to assign probabilities to specific future conditions, but to generate inputs for the Board and management when considering the company’s strategy, while also identifying potential risks and opportunities.

Reflecting our increased focus on sustainability, we established our Board Sustainability and Safety Committee in May 2022, and continued to reduce our Scope 1 and 2 GHG emissions and our waste and water intensity. Beyond running our business sustainably, we are providing solutions that help our customers and communities on their net zero journeys. In Singapore, we are actively contributing to the country’s Green Plan 2030 and have also supported the Green Nation Pledge.

To promote environmental protection and climate action, we worked with various partners to launch a series of educational and public outreach programmes, and also provided carbon management training for Keppel’s suppliers. We launched the Living Well programme in Vietnam, in which Keppel Land and Keppel Infrastructure collaborated to provide clean drinking water for about 20,000 villagers, and plan to expand the programme in other communities where we operate.

Apart from environmental issues, we are also addressing the G and S aspects of ESG, including enhancing the diversity of skills and experience on the Board, promoting inclusive behaviours in the workplace, addressing the needs of migrant workers and caring for our workforce. In response to rising prices, we implemented a one-off cost of living subsidy for our more junior colleagues, and also enhanced our flexible benefits programme for our junior to mid-level colleagues. We are also supporting vulnerable communities in Singapore and overseas, including committing $1 million to Dementia Singapore to support persons with dementia and their caregivers.

We are encouraged to see our efforts recognised with the inclusion of Keppel Corporation in the Dow Jones Sustainability World and Asia-Pacific Indices last month. We maintained our triple A rating in the Morgan Stanley Capital Index (MSCI) ESG ratings, and are also honoured to be conferred Winner of the Singapore Corporate Governance Award 2022 (Big Cap) at the Securities Investors Association (Singapore) (SIAS) Investors’ Choice Awards for the second year running. Keppel Land also received a number of awards for its sustainability performance.

A company is nothing without its people, and I want to thank our dedicated Keppelites for your many contributions and sacrifices as we worked hard to execute our vision. I am heartened to see that we continued to perform very well in our Employee Engagement Survey, with an engagement score of 84%, higher than Mercer’s global average of 80%. 88% of our staff are proud to work for Keppel, while 85% are inspired by Keppel’s mission to provide solutions for sustainable urbanisation. We have a noble purpose that is highly relevant to the world today, and I believe Keppelites have every reason to be very proud of how we are making a difference.

I would also like to recognise the contributions of our colleagues in Keppel O&M, for whom the past few years have been challenging as we battled first the downturn in the O&M sector, followed by the disruptions caused by the COVID-19 pandemic. Despite tough conditions, the management and staff of Keppel O&M continued to give their best, reducing overheads over the past few years and winning some $8 billion of new orders in 2022.

Keppel started from the maritime sector, and the decision to spin off the O&M business is therefore not an easy one. But we believe this is a necessary decision, and a win-win-win proposition for Keppel, our shareholders and colleagues in Keppel O&M. When completed, the transactions will allow Keppel to accelerate the execution of Vision 2030, and unlock $9.05 billion1 in value over time. Keppel’s shareholders will receive 19.1 shares2 in the post-transaction Sembcorp Marine for every Keppel share held. Very importantly, it will create a premier global player in the O&M sector. These are thus interesting times for the industry and I wish colleagues in Keppel O&M success as you seize opportunities ahead, potentially as part of a larger entity focused on providing offshore renewables, new energy and cleaner solutions in the O&M sector.

2023 will be a very important year for Keppel, as we take the next leap forward in our Vision 2030 trajectory to become a global asset manager and operator, providing solutions for a sustainable world. We are not just an asset manager, but also an operator with very strong development and operating capabilities. This is a key differentiator for the Group.

With the growing global focus on sustainable development and climate change, I believe Keppel is in the right space at the right time, with our comprehensive suite of sustainability-related solutions. While the macro environment is expected to remain volatile, I am confident that we can build on the momentum Keppel has achieved to deliver strong value for all our stakeholders.

I wish you good health and a happy new year.

Footnotes: